The International Consortium of International Journalists (ICIJ) has released what they claim is a 2.94 terabyte data trove exposing offshore secrets held by wealthy elites across more than 200 countries and territories, calling it Pandora Papers.

On Monday, the central government said it will investigate cases related to the massive leak of financial documents, known as the “Pandora Papers,” and take appropriate action, as required by law.

“The government has taken note of this development. The relevant investigative agencies will review these cases and appropriate legal action will be taken where necessary,” the ministry of finance said in a statement.

“To ensure effective investigation in these matters, the government will engage with foreign jurisdictions for the purpose of obtaining information on relevant taxpayers and entities,” the statement added.

In addition, the ministry stated that the Indian government is part of an intergovernmental group that ensures collaboration and experience sharing to effectively address tax risks associated with such leaks.

“It may be noted that following earlier similar such leaks in the form of ICIJ, HSBC, Panama Papers and Paradise Papers, the Government has already enacted the Black Money (Undisclosed Foreign Income and Assets) and Imposition of Tax Act, 2015 with an aim to curb black money, or undisclosed foreign assets and income by imposing suitable tax and penalty on such income,” it said.

An investigation carried out into the Panama and Paradise Papers revealed undisclosed credits of approximately Rs. 20,352 crore (status as of 15.09.2021).

Indian names in leak

‘Pandora Papers’ revealed the financial assets of rich individuals around the world, including more than 300 Indians, including businesspeople.

In the list of Indians revealed thus far, there are Anil Ambani, Vinod Adani, Jackie Shroff, Kiran Mazumdar-Shaw, Niira Radia, Sachin Tendulkar and Satish Sharma, among others.

The rights group Oxfam India has urged authorities to take immediate action and abolish tax havens following the publication of the Pandora Papers.

Developing countries are disproportionately hard hit by tax havens. Corporations and the wealthy who use tax havens are out-competing those who don’t. Tax havens also encourage crime and corruption,” Oxfam India CEO Amitabh Behar said.

Tax havens need to be eliminated so that the government has access to the tax revenue it needs to fund public expenditures, he said.

Several of the individuals featured in the leak have denied allegations of wrongdoing.

In a statement on Monday, Kiran Mazumdar-Shaw said her family trust offshore was legitimate and bona fide.

“Media stories reporting on Pandora Papers wrongly implicate my husband’s offshore trust, which is a bonafide, legitimate trust and is managed by Independent Trustees. No Indian resident holds “the key” to the trust as alleged in these stories,” Mazumdar-Shaw, the executive chairperson of biotechnology major Biocon, said in a tweet.

Pandora Papers leak

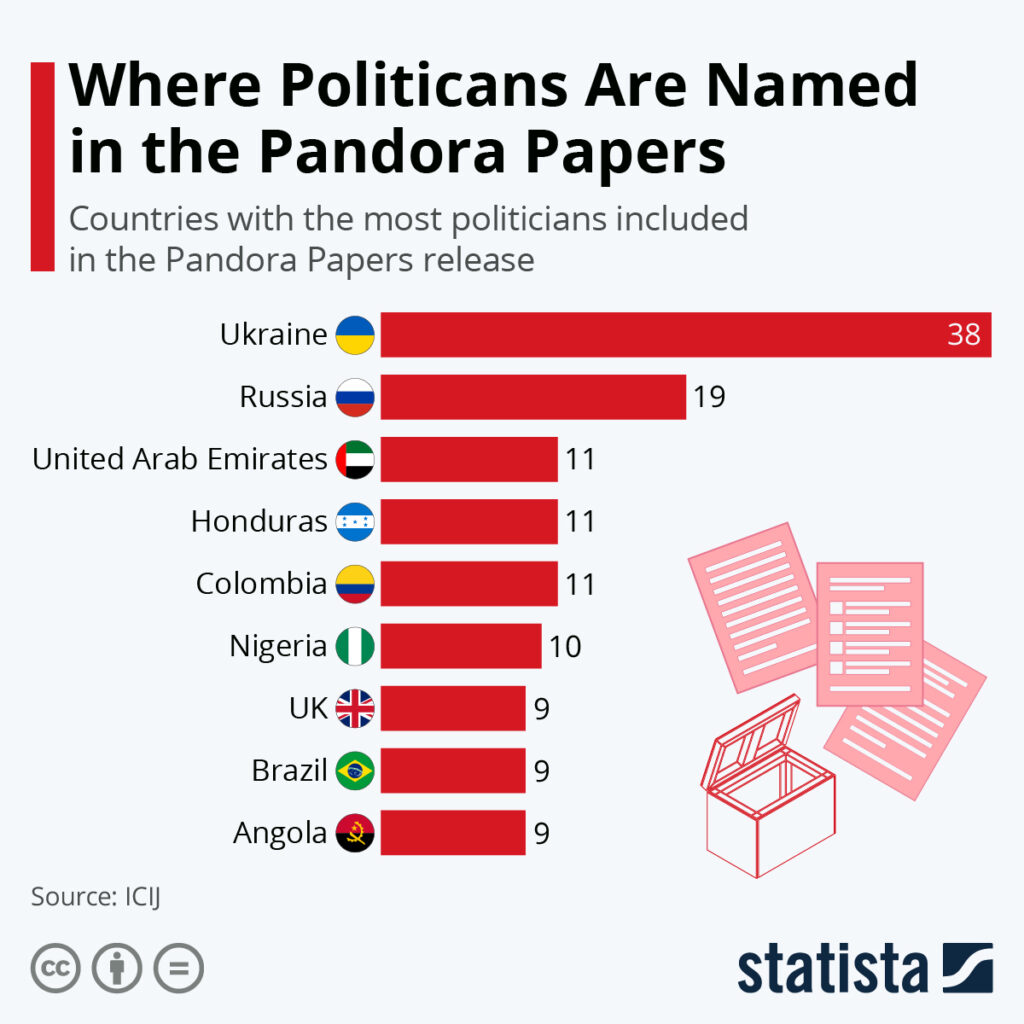

The ‘Pandora Papers’ have exposed financial secrets of politicians, world leaders, and public officials in 91 countries and territories.

In a world map showing the number of politicians involved in offshore deals, India was linked to six, and Pakistan to seven.

More than 330 current and former politicians were identified as beneficiaries of the secret accounts, among them Jordan’s King Abdullah II, former U.K. Prime Minister Tony Blair, Czech Republic Prime Minister Andrej Babis, Kenyan President Uhuru Kenyatta, Ecuador’s President Guillermo Lasso, and associates of both Pakistani Prime Minister Imran Khan and Russian President Vladimir Putin.

The report names billionaires including Turkish construction mogul Erman Ilicak and former Reynolds & Reynolds CEO Robert T. Brockman.

There were many accounts set up to evade taxes and conceal assets for other shady intentions, according to the report.

About 150 media outlets worldwide are involved in ICIJ. In India, it includes ‘The Indian Express’ and claims to have obtained up to 12 million documents from 14 offshore corporations.

Also read: Navjot Singh Sidhu’s Resignation: A Shock to Gandhi Family.