Business

Finance

Ratan Tata backed Mswipe Tech aims to transform into a digital SME bank

A PoS player, Mswipe Technologies, backed by Ratan Tata Associates, is seeking to transform into a digital SME bank within the next four to five years. The bank will focus on serving small merchants and their needs. As part of its plans, it will expand value added services, such as insurance, at point-of-sale terminals and

Embedded Finance in Healthcare: Health Care Expense Now a Tap Away

Embedded finance is reshaping India’s healthcare sector, simplifying the way people pay for medical services. This modern approach allows individuals to settle healthcare bills effortlessly through methods like tapping cards or scanning QR codes.

Why do Indian FinTech Companies continue to attract huge FDIs amid the global slump?

Indian FinTech market currently stands somewhere around $31 billion and is expected to touch the $84 billion mark by 2025.

FinTech in India is on the rise – as per latest reports

India is undergoing a fintech revolution. Recent research by the Boston Consulting Group (BCG) and the Federation of Indian Chambers of Commerce & Industry (FICCI) indicates that nearly two-thirds of the 2100+ fintech companies in India were founded in the past five years. Indian fintech is an extremely promising emerging market valued at USD 150-160

India’s FinTech Revolution – Rising popularity of fintech certifications

One of the fastest-growing economies in the world is India. Furthermore, FinTech has revolutionized the lives of people in this country. Fintech, which stands for Financial Technology, can be defined as any innovation that makes it easier for consumers to manage their finances. Thus, India requires talent with blockchain and cloud computing skills in addition

As a global engine of growth, India will make a significant contribution

As a result of a second wave of covid-19 infections, India is recovering from the debilitating effects on its people and economy and is poised to see strong economic growth, Indian foreign minister S Jaishankar said on Tuesday. At the Indo-Pacific Business Summit organized by the Indian foreign ministry and Confederation of Indian Industry

Drip Capital and SBM Bank India collaborate to empower MSME exporters

MUMBAI: Fintech provider Drip Capital on Tuesday announced a partnership with SBM Bank India to offer trade financing solutions tailored to small and medium exporters in the country. This partnership will allow micro, small and medium enterprises (MSME) to avail collateral-free working capital at competitive rates, the article said. Through our partnership with SBM Bank

Daimler AG plans to restructure its captive finance unit in India

Auto giant Daimler AG is considering reorganizing and spinning off its captive finance arm in India - Daimler Financial Services India Pvt Ltd (DFSI). The proposed move comes close on the heels of Daimler AG's global realignment strategy and its planned spinoff of Daimler Truck later this year. Daimler AG's Supervisory Board and the Board

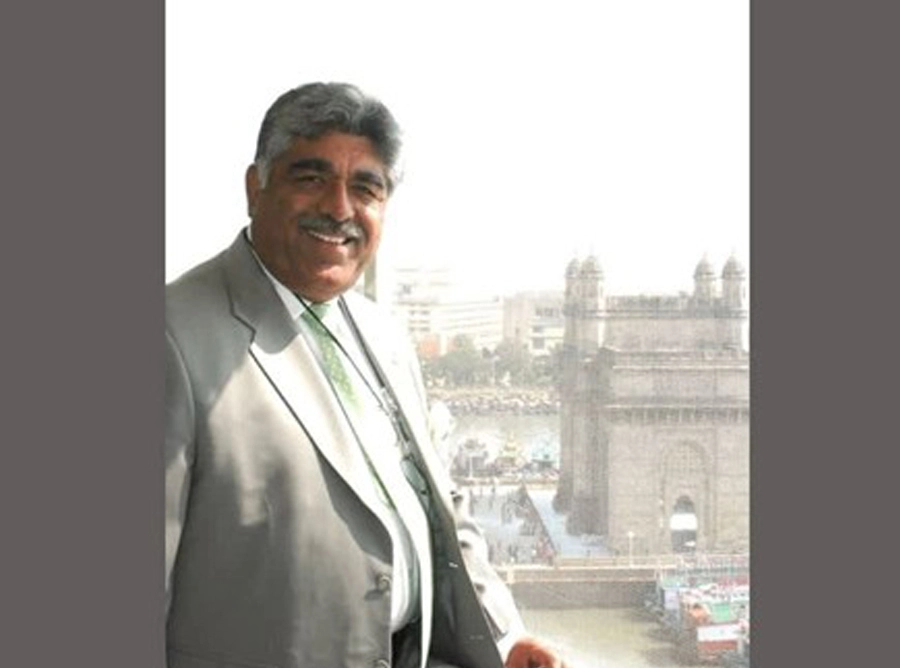

Insolvency and Bankruptcy Code, 2016: Gautam Khaitan Shines Line on the Subject of Operational Debt and Advance Payment

Gautam Khaitan analyses the subject of ‘operational debt’ as opposed to ‘debt’ within the functions of the Insolvency and Bankruptcy Code, 2016. As the head of the Corporate Divison at OP Khaitan and Co. law firm in Delhi, he has been imparting his litigation expertise within the corporate world since decades.

Rana Kapoor’s Stellar Record in the Battle Against Bad Loans

Yes Bank Founder and Former MD, Rana Kapoor recovered NPAs like a bullfighter and achieved lowest NPAs for 15 years in Indian Banking by relentless remedial efforts and timely recovery actions

Maruti Suzuki launches online smart finance to make car buying easier

Customers of Maruti Suzuki India Limited (MSIL) can now finance their vehicles online, anywhere and anytime, with Maruti Suzuki Smart Finance. Maruti Suzuki Smart Finance is now available to ARENA as well as NEXA customers. It is also available across India. It covers a wide range of profiles to meet the demands of a variety

New crypto regulations are ready for India’s monsoon session of parliament, says the country’s finance minister

India is getting closer to regulating cryptocurrencies within its borders. Deputy Finance Minister Nirmala Sitharaman told The Hindu that India's crypto bill is ready and the government has taken input from industry stakeholders. "We have worked hard on it. Taking stakeholder inputs into account. It is ready to go to Cabinet. "We need to wait

AGM Investment: Founded in 2016 by a Stock Trader, This Consultancy is making history

AGM Investment is a Country based Financial Consultancy and Educators which holds expertise in helping businesses take care of legal and financial aspects.

Krishna Mavila becomes torchbearer of stock market investment with his new book

Stock market investment is easier than beginners might think. Investor, trader and Author Krishna Mavila has effectively showcased this methodology in his newly launched book “Cracking the secrets of stock market investing”.

Ask Money Today: Would I be able to retire at age 41 with Rs 3 crore

Ask Money Today, Would I be able to retire at age 41 with Rs 3 crore. Read more

Related Posts

-

Fintech Sector Outlook for 2024

Indian Business Times 13 Dec 2023 -

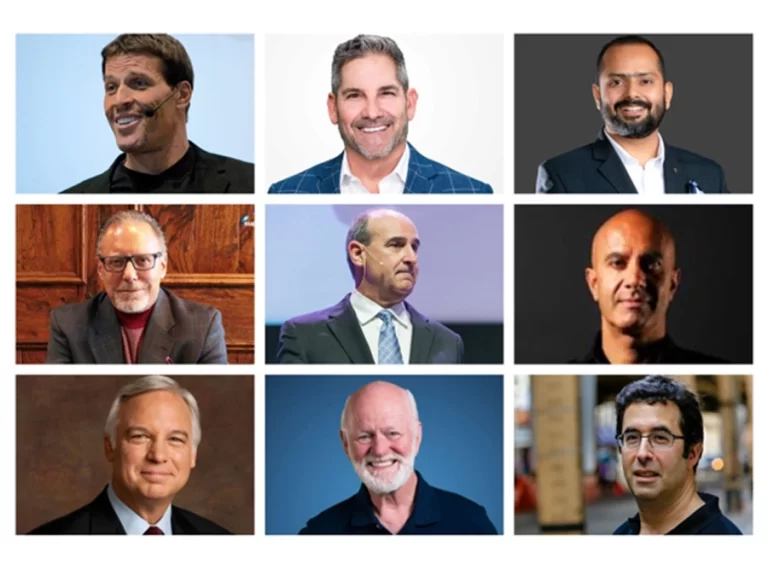

World’s Best Business Coaches

Nida Fatima 13 Jun 2023 -

Escalated Exchange of India

Shashank Bhandari 14 May 2025 -

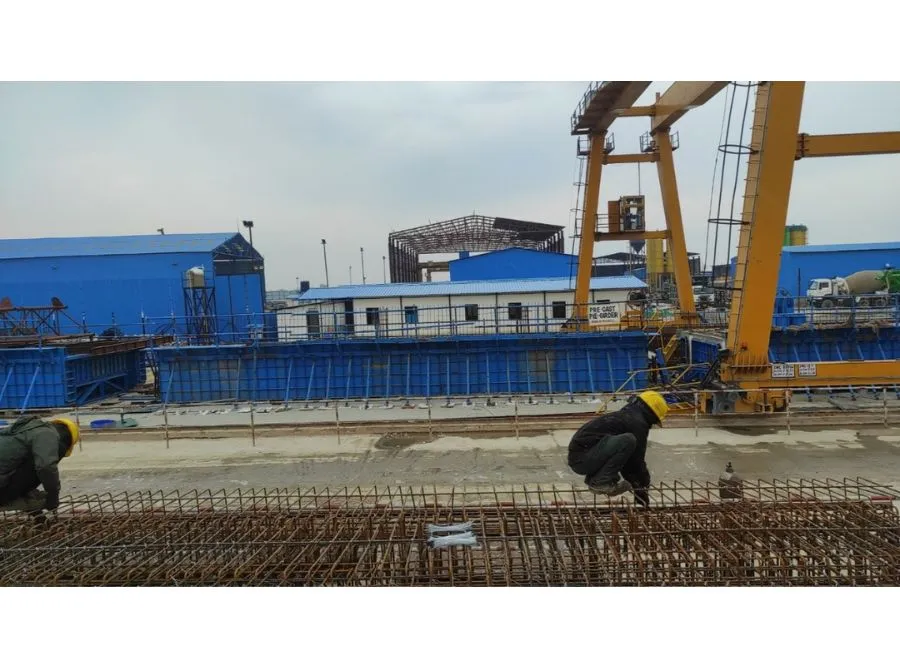

How to Scale Rapidly from Lab to Plant

Sachin Bansal 14 Oct 2025

Categories

We'd like to show you notifications for the latest news and updates.

_1740136197.jpg)

_1740547852.jpg)

_1744375393.webp)

(2)_1744726293.jpg)