Business

FinTech

Fintech Sector Outlook for 2024

As we approach 2024, the fintech sector stands on the brink of transformative advancements. This article delves into the dynamic interplay of technological innovation, legislative shifts, and evolving consumer behaviors reshaping financial services. Expect insights into emerging trends like decentralized finance, AI integration, and the burgeoning synergy of finance with other industries, heralding a new era in financial ecosystems.

Syed Meraj Naqvi Spearheads Innovation at Riskbirbal – Empowering India’s MSMEs with Tech-Driven Insurance Solutions

Syed Meraj Naqvi discusses Riskbirbal’s tech-driven approach to reshape insurance, focusing on MSME empowerment and innovative, client-centric solutions.

Portfolio Overlap Analysis – What’s the Common Thread?

Portfolio Overlap Analysis helps investors compare fund holdings to avoid over-concentration in specific stocks or sectors, ensuring diversification, reducing risks, and optimizing performance.

Ankit Agarwal Expounds on a Personal Finance Mobile App Market Outlook

According to Ankit Agarwal Alankit Group MD; In contemporary times, FinTech companies have undergone 360-degree revolutionary alterations and have given a new definition to efficiency in achieving targets that seemed like a dream traditionally.

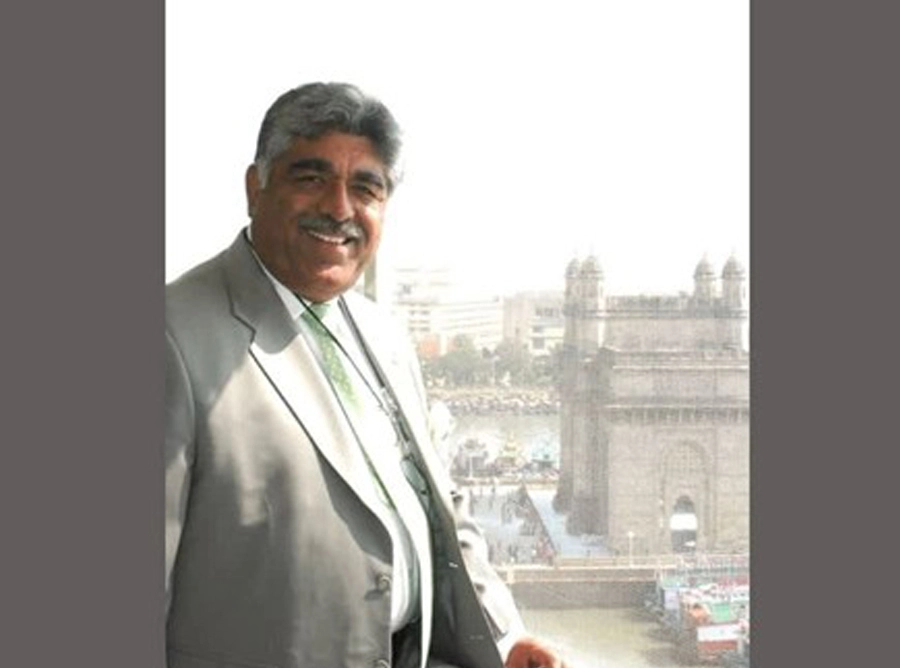

How Rana Kapoor had forecasted that banking would play a major role in making India a superpower

Rana Kapoor had opined that Indian banking system lies at the core of national development & will play an integral role in making the nation a superpower.

Smallcase – a Fintech Company enables ETF transactions with four AMCs

The move will make it possible for investors to buy ETFs curated by Smallcase on the websites or apps of HDFC AMC, Motilal Oswal AMC, Axis AMC and DSP Investment Managers.

Why do Indian FinTech Companies continue to attract huge FDIs amid the global slump?

Indian FinTech market currently stands somewhere around $31 billion and is expected to touch the $84 billion mark by 2025.

PINCAP: Taking A Quantum Leap In Navigating The Fintech Industry Towards Success

Only 7 NBFCs in India were given factoring licenses and Pincap is one of them. PinCap’s business & operational models are based on AI-ML and advanced analytics.

Pine Labs raises $600 million in funding and plans an IPO in 18 months

It is estimated that the firm is currently worth $3 billion. Pine Labs, one of Asia’s leading merchant commerce platforms, has closed a $600 million fundraising round, with the entry of new investors Fidelity Management & Research Company, funds managed by BlackRock, Ishana, Tree Line, a fund advised by Neuberger Berman Investment Advisers LLC. IIFL

FinTech in India is on the rise – as per latest reports

India is undergoing a fintech revolution. Recent research by the Boston Consulting Group (BCG) and the Federation of Indian Chambers of Commerce & Industry (FICCI) indicates that nearly two-thirds of the 2100+ fintech companies in India were founded in the past five years. Indian fintech is an extremely promising emerging market valued at USD 150-160

India’s FinTech Revolution – Rising popularity of fintech certifications

One of the fastest-growing economies in the world is India. Furthermore, FinTech has revolutionized the lives of people in this country. Fintech, which stands for Financial Technology, can be defined as any innovation that makes it easier for consumers to manage their finances. Thus, India requires talent with blockchain and cloud computing skills in addition

Maruti Suzuki launches online smart finance to make car buying easier

Customers of Maruti Suzuki India Limited (MSIL) can now finance their vehicles online, anywhere and anytime, with Maruti Suzuki Smart Finance. Maruti Suzuki Smart Finance is now available to ARENA as well as NEXA customers. It is also available across India. It covers a wide range of profiles to meet the demands of a variety

AGM Investment: Founded in 2016 by a Stock Trader, This Consultancy is making history

AGM Investment is a Country based Financial Consultancy and Educators which holds expertise in helping businesses take care of legal and financial aspects.

Ask Money Today: Would I be able to retire at age 41 with Rs 3 crore

Ask Money Today, Would I be able to retire at age 41 with Rs 3 crore. Read more

Healthcare Payments in India: Changing Times

Cash, Insurance, UPI, Credit Cards, Bank Transfers, and even Gold; are just some of the ways in which India pays for healthcare. In an illuminating conversation with Chris George- Co-Founder & CEO QubeHealth, a Mumbai-headquartered healthcare payments company, we delve deeper into how India is changing the way it pays for healthcare and how Indian families are managing their family healthcare expenses after the pandemic.

Revolutionizing Fintech: Nageen Kommu Unveils the Vision and Innovative Edge of Digitap in Exclusive Interview

Discover the journey of Digitap with founder Nageen Kommu, exploring its rise in fintech through AI and ML innovations. From revolutionizing digital lending to pioneering data privacy, learn how Digitap is reshaping BFSI and setting global benchmarks, all while balancing technological advancements with the human element in finance.

The Custodian of Continuity: How Soumik is Helping Indian Families Build Generational Bridges

Soumik Bandyopadhyay empowers Indian family businesses to navigate generational transitions with trust, structure, and empathy, helping preserve both wealth and values while fostering leadership, harmony, and long-term legacy continuity.

Related Posts

-

Fintech Sector Outlook for 2024

Indian Business Times 13 Dec 2023 -

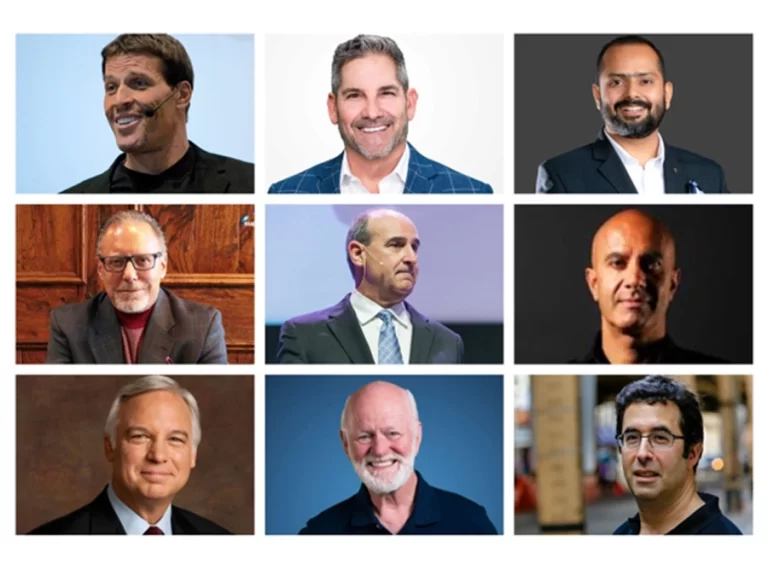

World’s Best Business Coaches

Nida Fatima 13 Jun 2023 -

Escalated Exchange of India

Shashank Bhandari 14 May 2025 -

How to Scale Rapidly from Lab to Plant

Sachin Bansal 14 Oct 2025

Categories

We'd like to show you notifications for the latest news and updates.

_1740136197.jpg)

_1740547852.jpg)

_1744375393.webp)

(2)_1744726293.jpg)