Business

India

Why do Indian FinTech Companies continue to attract huge FDIs amid the global slump?

Indian FinTech market currently stands somewhere around $31 billion and is expected to touch the $84 billion mark by 2025.

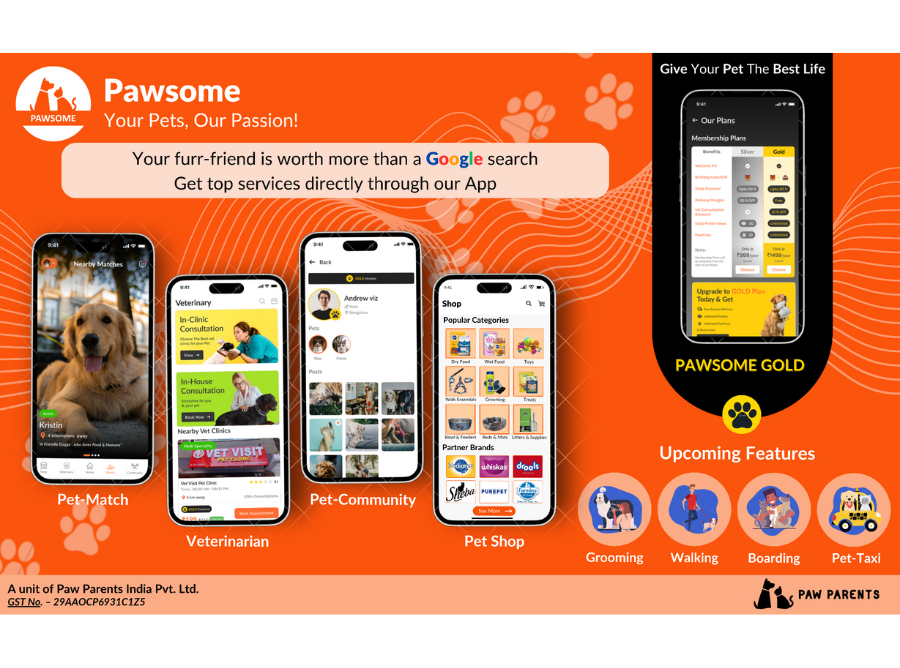

FinTech in India is on the rise – as per latest reports

India is undergoing a fintech revolution. Recent research by the Boston Consulting Group (BCG) and the Federation of Indian Chambers of Commerce & Industry (FICCI) indicates that nearly two-thirds of the 2100+ fintech companies in India were founded in the past five years. Indian fintech is an extremely promising emerging market valued at USD 150-160

India’s FinTech Revolution – Rising popularity of fintech certifications

One of the fastest-growing economies in the world is India. Furthermore, FinTech has revolutionized the lives of people in this country. Fintech, which stands for Financial Technology, can be defined as any innovation that makes it easier for consumers to manage their finances. Thus, India requires talent with blockchain and cloud computing skills in addition

As a global engine of growth, India will make a significant contribution

As a result of a second wave of covid-19 infections, India is recovering from the debilitating effects on its people and economy and is poised to see strong economic growth, Indian foreign minister S Jaishankar said on Tuesday. At the Indo-Pacific Business Summit organized by the Indian foreign ministry and Confederation of Indian Industry

Daimler AG plans to restructure its captive finance unit in India

Auto giant Daimler AG is considering reorganizing and spinning off its captive finance arm in India - Daimler Financial Services India Pvt Ltd (DFSI). The proposed move comes close on the heels of Daimler AG's global realignment strategy and its planned spinoff of Daimler Truck later this year. Daimler AG's Supervisory Board and the Board

Philippines and Vietnam are considering crypto-friendly legislation, unlike India

The fate of cryptocurrencies in Asian countries is not solely determined by China and India. As the popularity of digital tokens continues to increase, smaller players such as the Philippines and Vietnam are getting involved. According to the Philippines Stock Exchange (PSE), cryptocurrencies are an asset class they can no longer ignore. The crypto framework would make the existing exchange safer than foreign exchanges, they believe. Meanwhile, Vietnam’s Prime Minister – Pham Minh Chinh – has reportedly asked the country’s central bank to conduct a study of cryptocurrency in order for the government to run a pilot program in 2021 to 2023. During the last year, both of these countries have seen a massive increase in their citizens’ use of cryptocurrencies. According to the results of the Statista Global Consumer Survey they have the highest rate of cryptocurrency use after Nigeria.

Tax dispute freezes Indian real estate in Paris

PARIS: A Scottish energy company said Thursday it had won the right to freeze property in Paris owned by India, in its latest attempt to get back US$1.7bil (RM7bil) it says it is owed by New Delhi. Last year an international arbitration tribunal ruled that India should pay Cairn Energy US$1.2bil (RM6bil) in a complex

Escalated Exchange of India

India’s calibrated military response marks a bold new doctrine in counter-terrorism. With precision strikes and diplomatic poise, it signals a decisive shift in South Asia’s security landscape.

Related Posts

-

Fintech Sector Outlook for 2024

Indian Business Times 13 Dec 2023 -

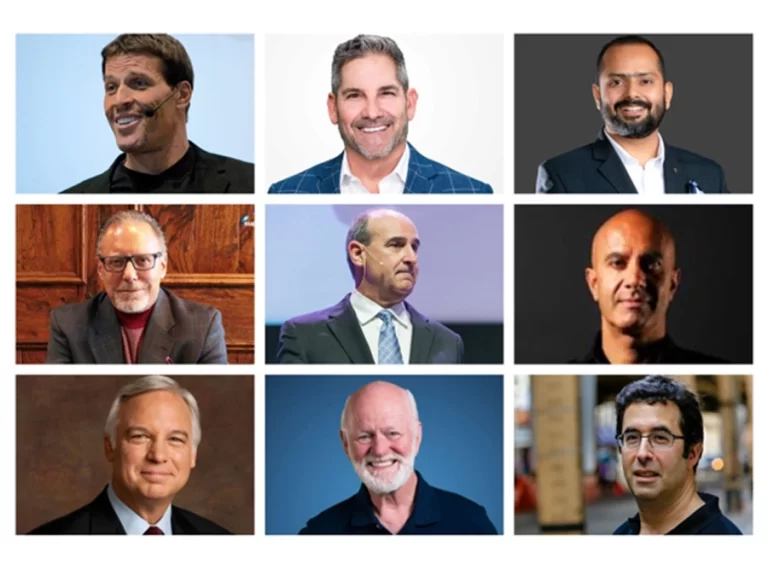

World’s Best Business Coaches

Nida Fatima 13 Jun 2023 -

Escalated Exchange of India

Shashank Bhandari 14 May 2025 -

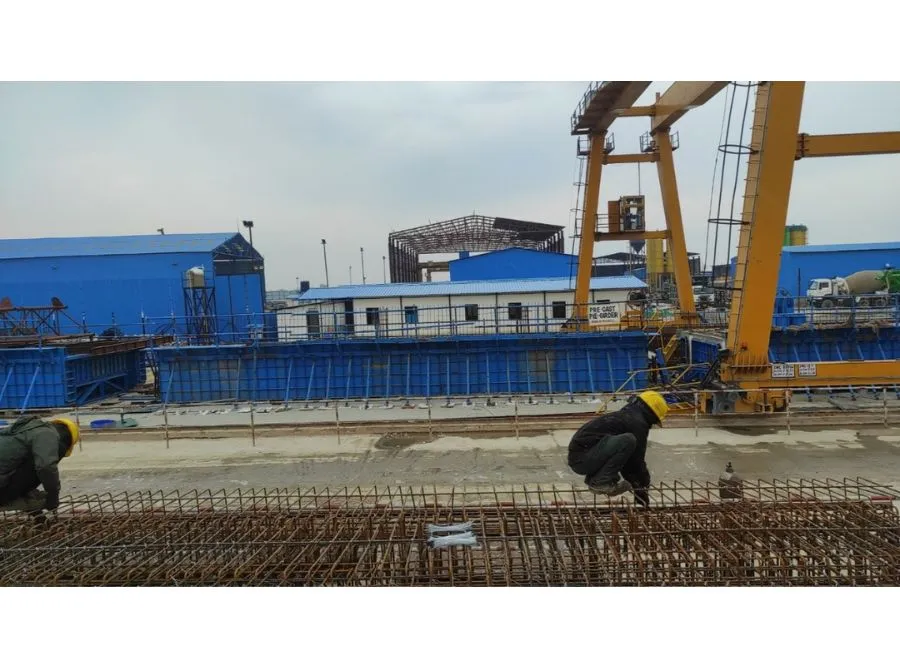

How to Scale Rapidly from Lab to Plant

Sachin Bansal 14 Oct 2025

Categories

We'd like to show you notifications for the latest news and updates.

_1740136197.jpg)

_1740547852.jpg)

_1744375393.webp)

(2)_1744726293.jpg)